Weekly PROPHET NOTES 9/9/24

Global Outlook: Harris x Trump debate, Apple conference, nearing FOMC

First week of September is behind and it wold be very fitting if I said that the first sign of fall are here, but the temperatures where I live have been so crazy that it still feels like peak summer. I hate cold weather so very fine with it, hope it can stay warm enough till the time I move which from my current residence. I still have a few things to take care of, but most of the work has already been done. Anyway, back to regular programming, let’s see what was the hot topic in the last week.

Weekly Recap

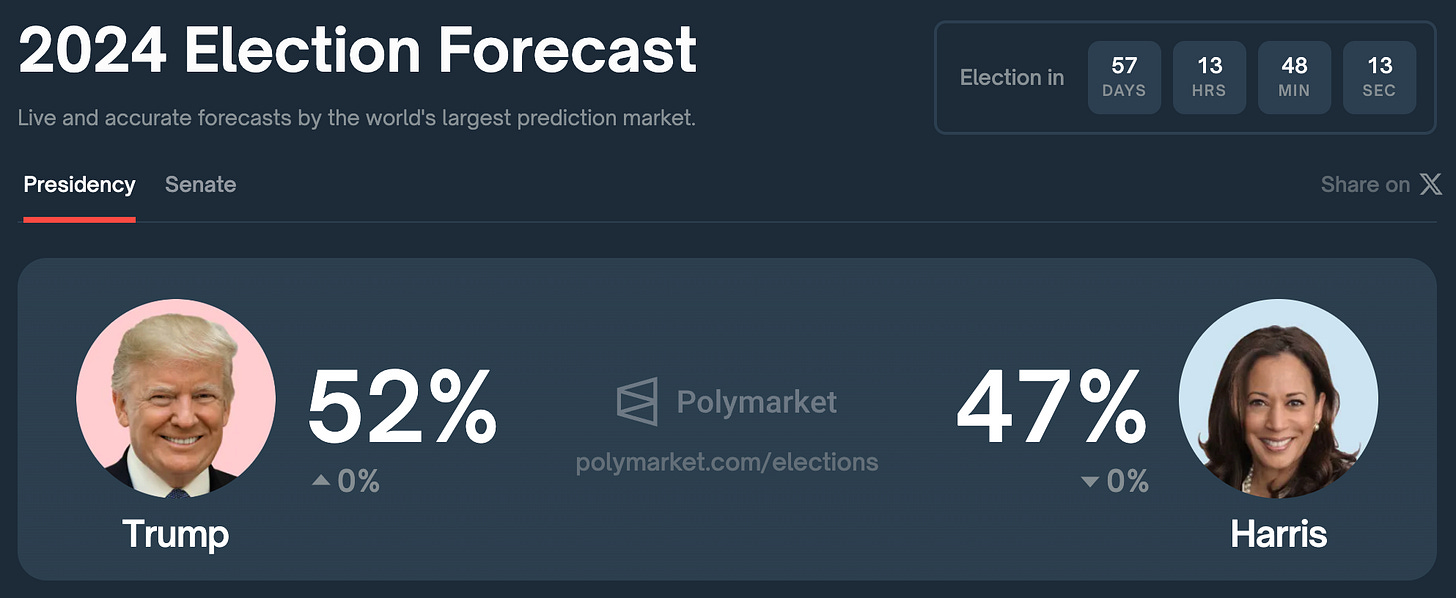

Trump has managed to maintain his lead over Kamala, although not without some turmoil. As the week was pretty boring political drama wise there was nothing to substantially move the market and yet we have seen some strange action on Friday. It all related to newly created derivative “meta” markets - Favorite to win on Polymarket on Friday.

The market has already closed, but there was an attempt to inflate Kamala’s odds in the main presidential market to reverse the outcome.

This is the price chart for Trump in the last week. As you can see there is a sudden drop - some traders have brought a few million to buy Trump No and Kamala Yes while holding Yes on the favorite market (bought cheaply just before the action). I kind of admire the attempt, but at the same time its failure show us the resilience of high liquidity prediction markets. You can read my short comment on this here.

Moving forward, some models like the one from Nate Silver give now Trump 63.8% chance of winning the election. This is the first major discrepancy vs prediction markets. Of course, his model accounts for a convention bounce for Kamala that may not be here, but I believe that with the recent NYT poll his odds are not that off. That being said, I believe that major moves on Polymarket are waiting for the debate. Considering the last one was instrumental in finally removing Biden from consideration, many are expecting a big night in the first clash between Trump and Harris.

I am holding some position on the debate happening tomorrow (easy money). I will also take a look at mention markets today and put out my thoughts on X.

Leaving US politics behind, we had some interesting markets and analysis last week. First up - Pershing Square:

You can read my short analysis here and here. I was able to buy some No at 50c which I consider great value. His funds’ performance on European stock exchanges + previous attempt make this 2nd round not that likely as well. Bill Ackman sadly did not respond to my request for comment (lol).

Additionally I have now a new No position on Apple to invest in OpenAI market:

I believe that this market is mispriced considerably - you can read my extensive analysis here:

Deep dive: Apple x OpenAI

We are once again deep diving markets. After a bit of a slow news cycle I finally have an interesting market to analyze. And this time I am outside of the usual politics / geopolitics landscape. Not gonna lie, politics and surrounding drama sometimes gets tiring, so I am glad that there is an interesting financial market to write about. After all I work in finance as my day job and I did M&A, JVs, Partnerships and other structures so I have something to say in this topic.

Maybe some are waiting for today’s iPhone presentation, but this is fool’s hope. This market is going to 30/70 soon. If I am right (I am), this is the best deal on Polymarket right now since NYC migrants getting prepaid cards. There are some markets that require hard to get expertise. M&A / Partnerships / etc. are one of the categories and we have already seen how badly these markets are priced. Be it TikTok x UMG deal or Paramount acquisition, both were easy money from a perspective of someone experienced in finance.

That is all from last week, let’s look ahead.

Global Outlook this week

We are looking at a busy season starting with the Apple conference today (I suspect some impact on the Apple x OpenAI market), the debate tomorrow and CPI print on Wednesday that should give us the final indication on the rate cut. The vacations are over and the world is back trying to capture our attention while I am all in looking for the next great deal on prediction markets.

US Elections

I have already said a lot on US elections topic in the weekly recap section. I am still holding Taylor Swift endorsement market Yes as well as both debate Yes markets:

This was value with really nice APY even a week ago:

This was even bigger value, understandably as the above market was more vague, but still the difference was astounding:

As for other markets I am taking a look at mentions market for the debate. I will probably fade bingo, unless I can find a good arbitrage between bingo and standalone mentions.

For the debate, I expect that both candidates will be quite well prepared. As it stands today, Trump has more to lose considering the odds, but for Kamala this is her first major trial. The recent CNN interview was not very good so I believe that she has done more now to perform well, but some things cannot be made better within a few weeks.

Mics off favors Trump as it will prevent him from rambling. But it also gives Kamala a clear ground for uninterrupted monologues. As a lawyer she should have at least decent performance.

I expect to see a slightly better Trump performance, but nothing that will actually tip the scales in any direction. Kamala is no Joe and she will be coherent. Even though she is know for her exceptional word salads it should not be a major issue. Her post debate coverage should be positive from MSM and that is all she cares about.

I still hold some Trump yes on elections market hoping to catch the convergence between statistical models and prediction markets and I am looking to offload most of it after the debate.

And that’s a wrap on US Elections.

Middle East

I am somehow glad that I have already written my deep dive on the Middle East as we entered another escalatory period. My thesis still holds with the recent developments. If you have not read my analysis you missed out on some serious long-term alpha, go and read it here.

Escalation seemed to have slowed for now and the thesis remains stable.

Compared to last week, traders aligned with my opinion and pushed no ceasefire option up to 57%. There is really nothing much to save in Gaza and for now anything other than full exit will be met with a strong no from Hamas. Especially now after recent dead hostages, ceasefire will be a tough thing to align on. September odds have dropped significantly as more and more traders realize that the path is different.

As expected the fearmongerning subsided and we are back to usual strikes between Lebanon and Israel with some renewed calls for Lebanon invasion. Somewhere in the next 2-4 weeks we will once again see an escalatory move. But for now, enjoy the sun.

Ukraine-Russia war

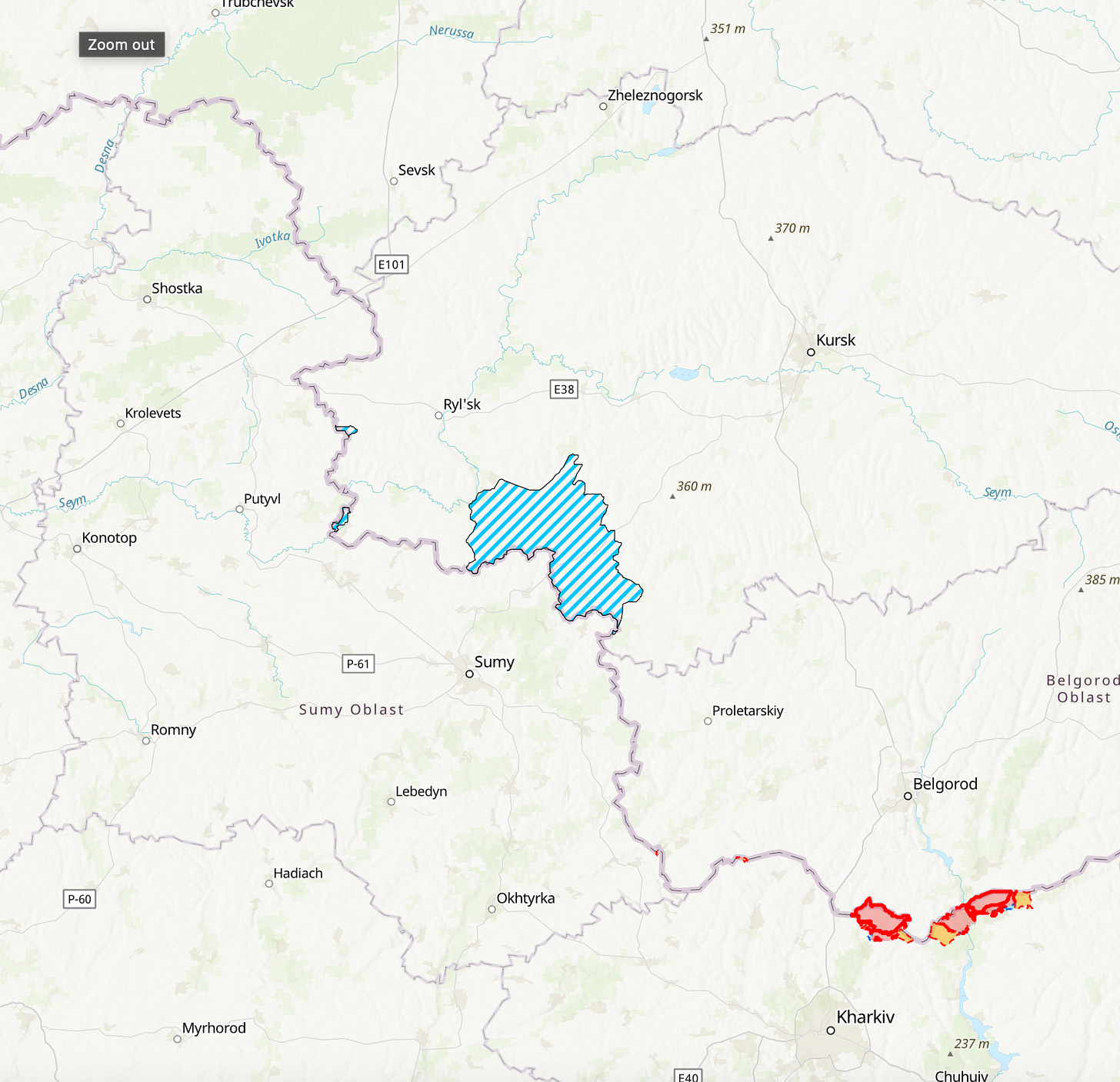

Situation in Ukraine seems quite stable for now. I did not even change the map screenshot below as nothing has changed (2 weeks now). Ukrainians still hold their minor Kursk position, but on the other hand situation looks contained for now. If I were Putin, I would block expansion and not waste additional resources to get rid of the Ukrainian army. I still maintain my view that the incursion was hopeless and offered no strategic advantage.

I will focus more on the Ukraine in the coming months, both in the deep dive I have started to write as well as in the weekly outlooks as with the cold season approaching, we will once again see more action there. Recent headlines we had were more airspace incursions in Poland and Romania which we are starting to get used to as well as a new report that a Russian drone has crashed in Latvia. Strange development that I will monitor as Latvia is nowhere near Ukraine.

As they say - winter is coming and with it I believe we will see more developments in Ukraine. We do not know the exact extent of the infra damage, but MSM reporting suggests that Ukraine will have major issues. I am targeting to publish the Ukraine article by the end of summer and will go through all this and more.

Europe

It is sad for me as a European that we have another silent week in Europe. Besides French election drama there is nothing really to report.

The new French PM was selected by Macron and it seems that despite a major blow in the elections, Macron’s party will still retain a lot of power. Funny how democracy works sometimes.

Asia

Due to lack of sufficient time, I don’t really cover Asia in depth now as there are no markets to take position on besides North Korean nuke (doubtful) and Taiwan invasion in 2024 (doubtful as well).

Let me know if you are interested in Asia to cover it in the future in more detail.

LatAm

Similarly to the above, the region isn’t really interesting from global events perspective. We have some Venezuelan mess right now, but it seems that Maduro’s grip on power is strong

As above, let me know if you would like to see LatAm coverage in more detail.

Finance

We are entering an interesting time in the finance world. This week we will see the newest CPI print that should set us the tone for the FOMC meeting next week and an eventual rate cut. A lot hinges on this one print, but the overall sentiment right now is on the 25bps cut.

I tend to agree with this for now. Powell is now know to act slowly and it is not in his playbook to go with 50bps cut. Additionally this would create some panic as such sudden drop after holding rates for so long suggests some deeper problem and vain hopes of solving it by cheap money.

On crypto side we are seeing some drops, after all crypto is not a store of value, rather an ultra high growth stock and a bet on blockchain technology. Any stock bear market will likely result in crypto bear market as well. Some are up so much that they stopped caring a long time ago, but for the rest it is important.

Wrap up

That’s all for the coming week. We are looking at increasing the pace of action starting today with Apple conference. I see No shares going a lot higher after it ends with no news on OpenAI investment. Additionally we have the debate tomorrow. I am in a tragic timezone to watch it live, but will do my best and sacrifice some sleep time to cover it live. Depending on the substance I may also dedicate the next deep dive for post debate analysis. We are nearing the elections and I should now spend more time covering my takes on who will win. As always, your feedback on content is appreciated.

This is not official investment or life advice. Do your own research. This are only my opinions and I encourage anyone to do their own research before putting any money anywhere.