Weekly PROPHET NOTES 9/30/24

Global Outlook: VP debate, Eric Adams drama and a hit and miss on the last deep dives

What a week! In a bit of a surprising turn (as in the info is out so early), it was reported that Apple is no longer considering investing in OpenAI, validating my analysis on the topic that was posted 2 weeks ago. With that, I (and all paid subscribers) booked a nice 3x on the event. While it is always great to hit on such a deal, the next paid article will feature a proper post mortem to show you what was predicted correctly and what did I miss that could have made the analysis better. Do not miss on the next EV+ bets and subscribe!

On the other end Gavin Newsom decided to not dip his pen and shouted veto. It happens, had internal odds at 60/40 so not really mad about this one. It is curious though that he faded polls and Democratic urge to regulate. Now back to regular programing. We had quite an eventful week with majority of the noise coming from the Middle East. On top of that we had a Zelensky address to the UN with new aid package.

Looking forward we have a VP debate among the others so we are also looking at a busy week. Let’s get started.

Weekly Recap

There is a lot to unpack here so let’s go and see the mix of ended markets and other events that unfolded in the last week.

US Politics

A myriad of mentions markets flood Polymarket each week and last week was no different. I will not focus on them much here as retrospect on them is not really that interesting, but I traded a few of them with mixed results, overall being slightly on the plus side.

From other markets, the Springfield visit one:

I managed to get the No here at 73c last week making it a massive value play. It is a sham I did not put more there.

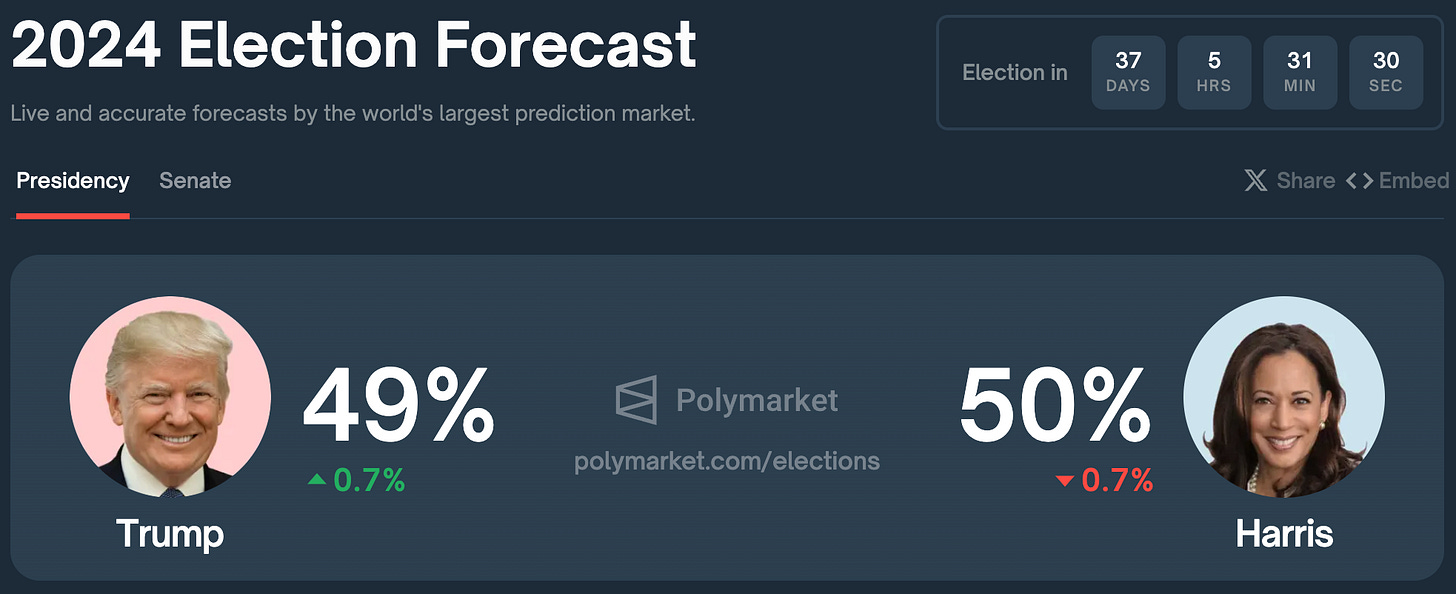

With both candidates focused on rallies, we do not see much drama on the politics front. Election odds have also stabilized with Kamala on a very slim lead:

I will be back with more US politics later on.

Finance

Here I have the most recent banger - Apple was confirmed to not invest in the upcoming OpenAI investment round. You can read the report here. I (and paid subscribers) are definitely not surprised as this is exactly in line with the deep dive from two weeks ago:

What is a bit surprising is the timing as I expected the news to drop much later on. This may have been fueled by the ongoing staff drama in OpenAI. Top executive turnover being so high on what seems to be the beginning of a massive growth path for the company is strange to say the least. High-level I see three options:

Scalability of LLMs is due to reach plateau and there is a need to change fundamentals (ie. approach) to further develop AI capabilities.

More complex models (eg. o1) are too expensive.

Sam Altman is a nightmare to work for.

More on this later in the week, but the situation is certainly interesting.

In other finance news I am still waiting for Bill Ackman to respond to my question on X (lol), while my bet on No IPO for Pershing Square in 2024 continues on its path to 100c:

Wars

Israel really outdid itself this week. Massive bombing of Beirut, resulting in death of Narsallah as well as retaliation in Yemen. On top of that in just a few hours they eliminated the next head of Hezbollah.

Shame I did not bet more here seeing Israel is on a killing spree, but I will gladly take the W. That being said, the overall situation in the Middle East looks bad. While Iranian first proxy is decimated and with the original leader dead (Hamas), the second one lost almost its entire command (Hezbollah). At the same time the third one is a bit inconsequential and is targeted heavily each time it involves itself (Houthi).

While Israel showcased major rehabilitation since October 7th intelligence fiasco, I believe that a few red lines were crossed for Iran and I cannot imagine a scenario in which they do not at least retaliate.

In my original Middle East thesis I anticipated escalation of Israel x Hezbollah conflict somewhere in October / November, but I did not suspect that Israel will start it with such an upper hand.

Coming around to Ukraine, we had Zelensky addressing the UN, where a bit of talk about peace and afterwards an announcement on the new aid package. On top of that there was a bit of gossip on the long range missiles - if it happens in tandem with the Middle East escalation we are looking at two wars out of control. Dangerous times we live in.

Pop culture

Besides all the important events, last week also marked somewhat of an end to the FTX saga. With Caroline Ellison sentencing (and a good analysis on my side) we have the star witness getting two years in prison. Some were betting on no prison time, but in my opinion two years is still a slap on the wrist as Caroline was instrumental in all the illegal stuff happening and only started cooperating after being charged. Actions should have consequences.

That is all major news from last week, let’s look ahead.

Global Outlook

With some major Ws in the last week I am looking to keep the momentum going. Let’s see what is ahead, first by checking markets ending this week.

Markets ending this week

US Politics

First up, on Tuesday we have the VP debate. Along with this, we have a few market on the debate. I will parrot Ivan here and say that among all the handshake, speaking time and who won the debate markets there is little EV+ to be found. Mentions markets are the ones worth looking at, but the upside there is quite limited as well. A bit of value on the Harris / Trump mentions as they are the stars of the election and previous VP debates were full of main candidates mentions.

Then we have a more localized news - Eric Adams got indicted on corruption charges and markets are looking on when he will resign form office. Charges are solid so he will resign eventually, question is when. For now he (as all politicians in trouble) maintains that he will not resign. Pinpointing the right date will be tough, but for sure I would not like to hold the No side here considering the pricing:

Probably the nearest moment of him changing his mind is on Wednesday, but this is nothing sure. Yes side provides big upside. I may allocate a small amount here considering a 12x return, but need to read on this a bit more. Majority of the value here sits in the rules - his announcement will suffice for a Yes resolution, he can still hold office and resign next month as long as he announces that he will.

And that is a wrap on the US, some strong markets this week.

War

With Israel on the offensive we are seeing a lot of Lebanon invasion markets. Proper invasion will not start today, but considering loose rules on some of these markets, I am not comfortable holding any positions there. I sold a No position on this market in the early morning, just before the swing:

Bought No for 87c, sold for 88c - this market will go for dispute and these have a tendency to be really misleading. We have now reports of some targeted raids so if you like to gamble on disputes, this is the next big thing.

On the Ukrainian side, there is an interesting market:

Russians are currently one block away from capturing the church in Toretsk that will suffice for a Yes resolution. This can be a close one - if I were on the No side I would cash out, if you are on the Yes side, there is no harm now in waiting till the end.

Other markets

Besides these ones, I do not see anything other that peaked my interest. As usual there are a lot of sports, pop culture and crypto markets, but I do not see the edge there and will not comment on them.

I have already covered markets ending today last week. It is the end of a months so many markets are near deadline, most are bonds though priced at 99/1 so you can look at them for a short term deposit.

New markets from last week

US Politics

I have covered the upcoming VP debate so in the new markets I will focus more on the Eric Adams story. First on is a rather interesting market on Hochul removing Eric Adams from office:

Similarly to other cases (head of Secret Service, Biden, etc.) the persons that are forced out of office / race are usually given a good chance to do this themselves. If Eric Adams resigns this week, it will be shown as a choice he made for the better of the people of New York. I would put the odds of this market at 10/90 thus I am going in for the No here.

This one though is a bit more tricky:

It all depends on the timing. If Adams resigns this week, the special election could be held during the presidential one. If he is not that pressured though, this may take a while. If we take for example though the case of Andrew Cuomo, he resigned something like a week after the report on him came out. That means there is pretty high chance overall for this to happen and considering that the chances of Adams resigning by the end of the year are at 52%

the special election market should trade at probably at least 25/75.

Middle East

Now back to the war again. First up we have Iranian retaliation market:

Being honest, I got a bit burnt on the previous one (while the first one hit perfectly). With 36/64 odds it look fairly priced so I will not participate for now. Iran has a few ways to retaliate, wise to wait at least till the Israel x Hezbollah war situation clarifies.

Next up we have a ceasefire market between Israel and Hezbollah:

I do not really think that there will be one. Hezbollah does not have any prisoners, etc. that are of interest to Israel. They will fight till the end. I am punting some No there.

Last one on the Middle East front is on the US Beirut Embassy evacuation by the end of October:

This is an interesting one as contrary to the Ukraine war, now the country attacking is US ally. Also a full evacuation needs to happen and considering that embassies do not only diplomacy, but also espionage, I expect it to be staffed even during conflict. My internal odds on this are 20/80, so I am punting some No here as well.

And that is a wrap on new war markets

Finance

Last section I will cover today. First on we have a new recession market:

Resolution timeline is quite long, but for the market to resolve to Yes, we would need Q4 and Q1 to have a decline in GDP. Considering that the hold up period for funds in now ca. 7 months, the odds seem fairly priced.

Lastly we have some OpenAI markets. Sam Altman, the last man standing is not going anywhere, so if you like near bonds, this is the market for you:

Next up we have two related markets:

Both of them are essentially a bet on turning to for-profit. One though has a deadline of end of April while the other EOY. This will be a complex transition so I believe that these are priced fairly. For now I am fading these as I have better deals to allocate my funds to, but may look at them again in the future.

Wrap up

That’s all for the coming week. This time we were given lots of interesting markets. I am looking to continue the good momentum from last week and I hope you also chose your winners right! Thanks for support, and we will see each other again in this week’s deep dive, topic TBD.

This is not official investment or life advice. Do your own research. This are only my opinions and I encourage anyone to do their own research before putting any money anywhere.