I have been reading Nate Silver’s new book On the Edge. I was genuinely surprised that he has such an easy pen. Despite the book being quite general, it is an engaging read and I highly recommend it to anyone. There are nuggets of really useful information there.

Anyway his book, specifically the division of people between the River and the Village, inspired me to do an experiment. With this weekly global outlook I was trying to fit into current news industry and provide general forward looking news every Monday morning. If Nate’s division is correct though, my approach will not resonate with the village people (who are main politics enthusiasts) and at the same time it will not entirely resonate with the River people (who should be more focused on finding EV+ bets and trades). Additionally there is little overlap between my paid content and the global outlook at the moment.

I am experimenting with the new content. From now on we will have:

Weekly Recap section, where I will recap resolved markets from last week that I had interest in / position in to give a short background and kind of post mortem analysis,

Global Outlook section, divided into two subsections:

Markets ending this week, where I will go through the most interesting markets bound to resolve this week, mostly in search for some bonds as well as to showcase main things to happen (or not happen) this week,

New markets from last week, where I will go through the most interesting markets created last week in search for mispriced odds.

Focus still stays on politics, geopolitics, business and finance. This way the weekly global outlook will nicely complement weekly deep dives as often one of the new markets will be put under scrutiny.

Let me know what you think of the new format. Now let’s go and see what is happening in the markets.

PS: I would love to cover Kalshi here, but for the time being I am not allowed to trade there as I am not American. As soon as it changes (I sincerely doubt it will be soon, regulators are painfully slow) I will cover Kalshi as well. For now I stay in crypto space (maybe for the better).

Weekly Recap

Last week was dominated by US politics with the first debate between Harris and Trump on Tuesday. There were a lot of debate and debate adjacent markets giving us a lot of action. Besides US politics, there were a few financial and pop culture markets, but most of them are not appealing to me as I do not see the edge there.

US Politics

I had a good week in general on US politics. First on the easy markets:

Both easy markets that allowed for quite big annualized yield for essentially a sure thing. If you have a bankroll above $1,000 it is worthwhile to put in your free capital in such markets as getting a few dollars is better than none. You can treat this like an overnight deposit / short-term bill - companies do this all the time with cash on hand. 1% return might sound too insignificant, but if you find such deals every week, you are looking at 69% annualized. Pretty decent compared to 8%-10% from S&P500.

Next on we have mentions markets and bingos. I faded them as I was unable to watch the debate live, but I highlighted an EV+ play on bingo 2 and 3 before the debate. There was no arbitrage opportunity as bingo is 2-dimensional probability plane and single mentions are 0-dimension (we lacked 1-dimensional markets ie. specific bingo rows / columns to make an arbitrage play). I will not go into detail on each mentions markets, but all three bingos missed so there was a nice return to make on bingo 2 and 3 considering the play was EV+.

There were a few other debate related markets, but I struggled to find a reliable edge on them so I will leave you to check them out if you want.

Next on is the market I feel a bit unhappy about. I am talking about Taylor Swift endorsement market. I was really looking to put more capital on Yes there once the funds from debate markets were free, hoping that Taylor will endorse in October, but I have been surprised to find out that Taylor has endorsed Kamala just after the debate.

Nevertheless, I am happy that the underlying rationale for the endorsement position was strong and that the prediction hit. The price for Yes was stuck in the 70c-80c range for quite a while, making this one of the best EV+ plays on Polymarket recently. If you want more markets alpha, subscribe and read some of the deep dives - prediction markets are tough and there are a lot of mispriced markets.

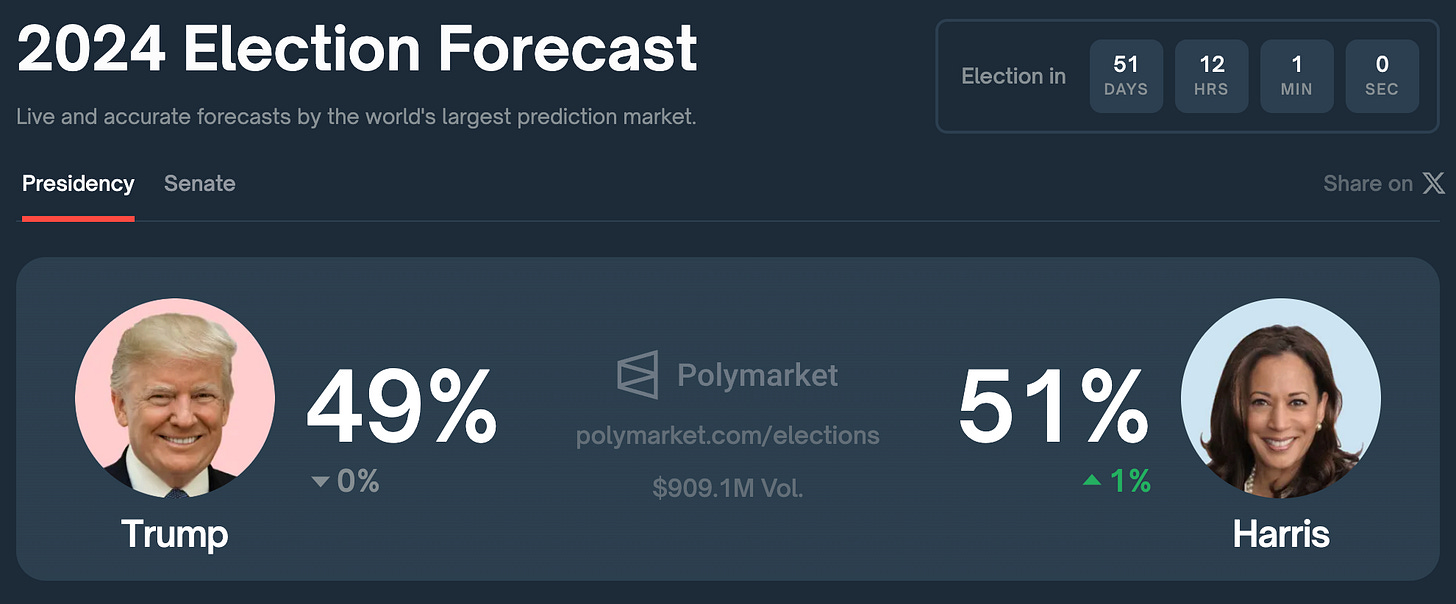

Coming to more general things, I have posted my thoughts on the debate on X. In one sentence, Kamala’s performance was stronger than anticipated while Trump got baited several times. Overall the market anticipated stronger Trump performance (including me) thus we see the reversal and a marginal lead for Kamala.

That is all on election markets. There were also mention markets on both Harris’s and Trump’s rallies, but having a busy week I faded these as well.

Finance

Last week we had long awaited CPI print. Based on the numbers, the Fed will take a decision to cut rates. The CPI printed at consensus - 2.5% annual and 0.2% m/m.

Polymarket consensus was at essentially 50/50 on both indicating a close read between 2.5%-2.6% on y/y and 0.1%-0.2% on m/m basis. I will be back with financial analysis on Ending Soon section with rates markets.

Pop Culture

There was nothing much in terms of general / pop culture markets besides number of tweets from both Elon Musk and Trump. Besides betting one time on small number of Trump tweets as it was severely underpriced I generally do not enter these markets. I do not think there is any edge to have and I would treat it rather like a bit of fun vs something to make profit of for the long term (unless you are farming rewards).

That is all from last week, let’s look ahead.

Global Outlook

Last week was a busy one. A lot has happened, especially in US politics. Let’s see what the next week will bring us in terms of markets ending.

Markets ending this week

US Politics

Starting again with US politics, we have yet another mentions market, this time on Trump and his next X space on Monday. We have quite a selection of crypto focused mentions to choose from, but first market I see value in is Elon Musk:

At 57c, Yes strikes me as value - the interview is on X spaces after all and Elon Musk is a big name in this campaign. My guess is that they might start with his topic, talking about the first X space with Elon Musk.

On top of that we have a few Trump sentencing markets that should all go to No since the sentencing is delayed post elections. Additionally there are a few polling markets: general, 538 and Nate Silver’s where it looks like Kamala will take all of them. That being said I am not comfortable on betting on other people models and I do not see any edge there.

If you are looking for a bond, there is a Trump affair with Laura Loomer market:

Laura Loomer is a good friend of every EV+ bettor as she is always happy to provide exit liquidity by spewing bullshit at her followers. I am happy to take their money and so should you be.

Finance

We have a big week ahead in finance. The FOMC is there and all expectations are on the rate cut:

With the recent CPI print and last comments by JPow, all are just short of being sure of a rate cut. The main question now is how much will he cut. And here bettors are divided:

Monetary policy is incredibly difficult to anticipate, as the simple action of cutting is only half of the job and half of the effect - usually comments from JPow (or any other Fed chair) are equally as important and can make a lot of difference.

Many agree that JPow is late and should have cut on the last meeting. At the same time, a 50bps cut is an aggressive one. 25bps seems like a sweet spot with indication of further rate cuts ie. the beginning of cutting cycle. I am holding a small position on the 25bps cut market as in my head the odds should be more like 60/40.

Trad markets do not agree with me on this currently (link), but with no cut on last meeting, I do not really see the need to go to 50bps cut now.

Other markets

Besides these ones, I do not see anything other that peaked my interest. As usual there are a lot of sports, pop culture and crypto markets, but I do not see the edge there and will not comment on them.

New markets from last week

US Politics

First on, we have the most recent news - another Trump assassination attempt. We lack formal admission so this is still short of being a bond. At the same time all points to it being an assassination attempt:

We have a few other markets on this: rogue actor, US citizen (close to bonds) and registered D or R (a 50/50 as of now ie. no edge here unless you know the guy).

On top of that we have some Trump visits markets in September with Springfield on top of the list. I would not really bet on it with size on 50/50 odds, but there is some argument for Yes. Be your own guest on this market if you want.

Between some very unlikely events that I invite you to research yourself, there is an interesting market on another Harris Trump debate:

On one hand they have already agreed on the debate, on the other hand Trump is now backing out. The next debate will not change much, but I think that in the end they will have the debate. at 32c Yes seems underpriced and I may punt some Yes there in the coming days.

Ukraine War

With my piece slowly taking shape, we have a new market on the Ukrainian front:

With all the talk about allowing Ukraine to use long range missiles on Russia there is some chance for it to happen. That being said, 22% is way to high as for now only Canada agreed to it and US is still mulling it. Reportedly US needs to see a comprehensive plan for victory in order to agree. Such things take some time and we only have two weeks left in September. Additionally the missile / drone needs to actually hit to resolve to Yes. Intercepted missile / drone does not count. I am punting some No there.

Middle East

There is one new market on the Middle East as well:

I do not think I need to explain that there is nearly 0 chance of this happening (Golan Heights are considered part of Israel territory). If you like bonds, this is as close to it as possible.

Global Elections

We have also two new markets on global elections, one in Sri Lanka and other in Lithuania. I do not know the first thing about politics there, but may look into them in the near future to see if there is any value there:

Pop Culture

Last focus is on pop culture - we have another sentencing in the FTX case coming up. Caroline Ellison sentencing is set to happen on September 24th:

Considering she was a witness against SBF I see none to low prison time for her and might punt no prison time plus low ranges here. I will let you know on X. That being said I did not follow the case closely and I am not really sure what is the current sentiment.

Last market in today’s outlook is on Trump selling his DJT shares in September:

While I believe that there is high chance of him selling, I have my doubts around confirmation - high chance we might not hear about this by the end of September. I am fading this market as odds seem correct.

Wrap up

That’s all for the coming week. I like the new format with market focus and it helps me as well with choosing topics for deep dives. The pace is accelerating on the world stage and we are looking at some fun markets, both ending this week as well as new from last week. Let me know what you think of the new format and trade well.

This is not official investment or life advice. Do your own research. This are only my opinions and I encourage anyone to do their own research before putting any money anywhere.