It was expected that at some point the crazy news cycle that we witnessed during last month and a half must slow down. There are still things happening, but w can have a bit of a breather and focus on the world around us. Soon enough we will once again be drawn into the US elections cycle, wars and financial swing, so let’s dive into the week before and ahead and see what is shaping up to take our attention.

Weekly Recap

With the DNC upon us it was only expected that we will start to hear more about Kamala’s platform. The grand unveiling should happen at the DNC, but we have already had an opportunity to hear about the Democratic ticket’s economic plan. Kamala presented an aggressive platform, I will dig through it briefly and showcase its impact in the American landscape:

$25,000 for first time homebuyers in downpayment assistance. For everyone who understands basic economics it is clear that stimulating demand when the supply is the problem will only increase the prices. But considering current American landscape with sky high real estate prices, this promise, however absurd for me, is something that will be perceived as beneficial by an average American.

Construction of 3 million new housing units. This is a more silent, but also better part of the housing plan. As long as the promise includes subsidies, etc. for developers and not the government taking on the task of building, we cans say this is a strong promise that should resonate well with an average American.

A federal ban on "corporate price-gouging" on food and groceries. It is hard to say what exactly will this ban shape up to be, but overall this is the weakest part of the plan that is already under severe attack by both Republicans and moderate Democrats. This is sold as a plan to tackle rising COL and especially inflation on basic items, but in communist-averse American landscape, this one resonates really badly. My personal opinion is similar here - food industry is a very competitive and low margin industry (1%-3% in net profit margins) and usually any interference in the market process by the government ends up in making the situation even worse. I commented as well on the matter on X.

Raise minimum wage and end taxes on tips. This is Democratic bread and butter, nothing especially outstanding about this proposal, it should resonate well with left leaning voter base and be neutral / mildly good with moderates.

Capping the cost of insulin at $35 and out-of-pocket expenses for prescription drugs at $2,000. This is an attempt to strengthen Social Security and Medicare. I will not pretend to be an expert on American healthcare system, but such promises often work well with moderate voter base. I do not see it as a liability in the campaign.

Restore the American Rescue Plan’s expanded Child Tax Credit and she proposed a new $6,000 Child Tax Credit. When I saw this I got flashbacks on a lot of European platforms in the recent years. Such programs are widely popular among the voter base and this is an attempt to both bribe the voters as well as help to induce a baby boom. The first part works very well based on my European experiences, but the second aim is hopeless - many such programs proved that some additional money has little effect on birth rate.

Crack down on big food M&A. Connected to the ban on price-gouging, this is another weak part of the economic plan. It will gather little attention, but it shows that Kamala has no idea how to actually solve the problem (rising COL) and prefers to throw catchy slogans on it in the vein hope of gaining support of the poorer part of America.

Overall, as I posted on X, I believe that this is strongly leftist, populist platform. Not a surprise considering that Democrats failed to moderate their ticket by picking progressive Tim Walz vs moderate Josh Shapiro. The economic plan will resonate well with strong Democratic base, but will alienate moderate voters that see through the cheap bribes.

Staying in US politics, Trump tries to break out of shadow created by the fast approaching DNC and did two surprising actions during the week. First one was appearing on X Spaces with Elon Musk for an interview. A pretty uneventful one, but widely popular and touching once again on Kamala’s weak spot - unscripted appearances.

Additionally along with X Spaces appearance Trump started to once again post on X. I did a few posts around this topic on X and won a nice 2.5x on predicting his low number of tweets, but Trump managed to surprise me and despite having a lot of money tied up in Truth Social started posting on X more regularly. I assume that his campaign finally understood that Kamala is a tougher opponent than Biden and they need to step up their game and reach wider audience.

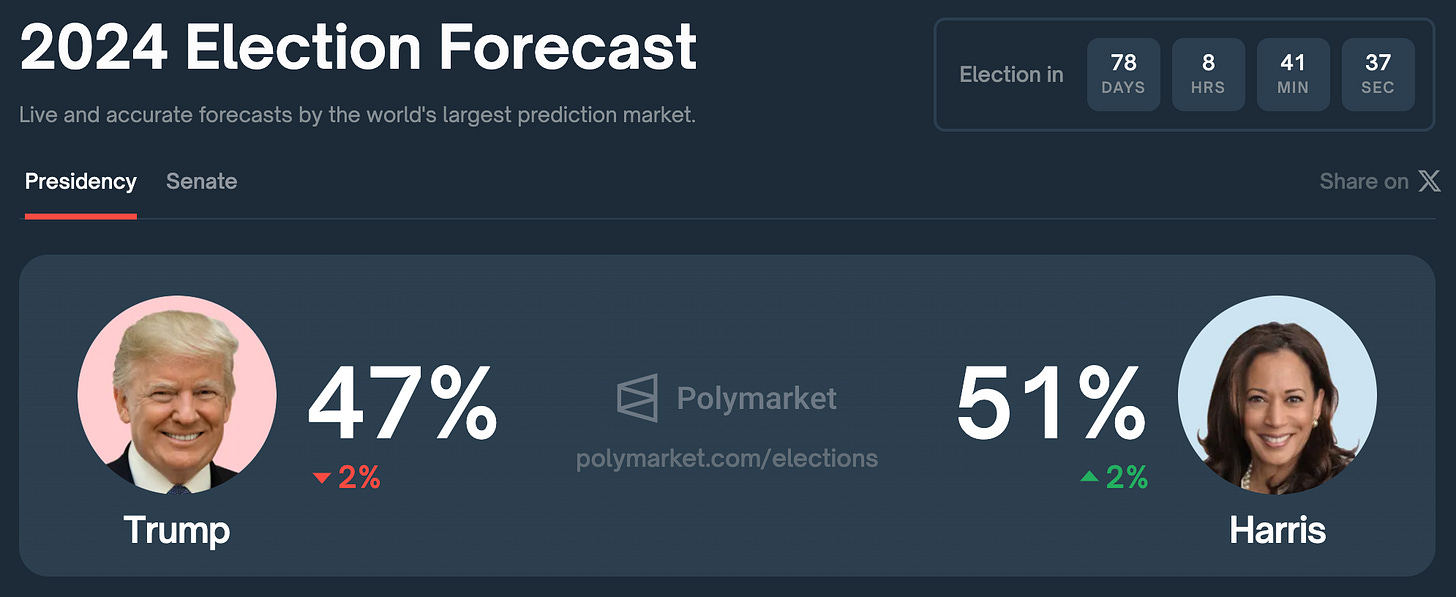

The effect of weak economic plan and Trump increased outreach was quickly visible in the Polymarket odds. At one moment yesterday the odds were 49/49 and even now we see that Kamala has lost the major lead she had and we are essentially in a toss-up territory now.

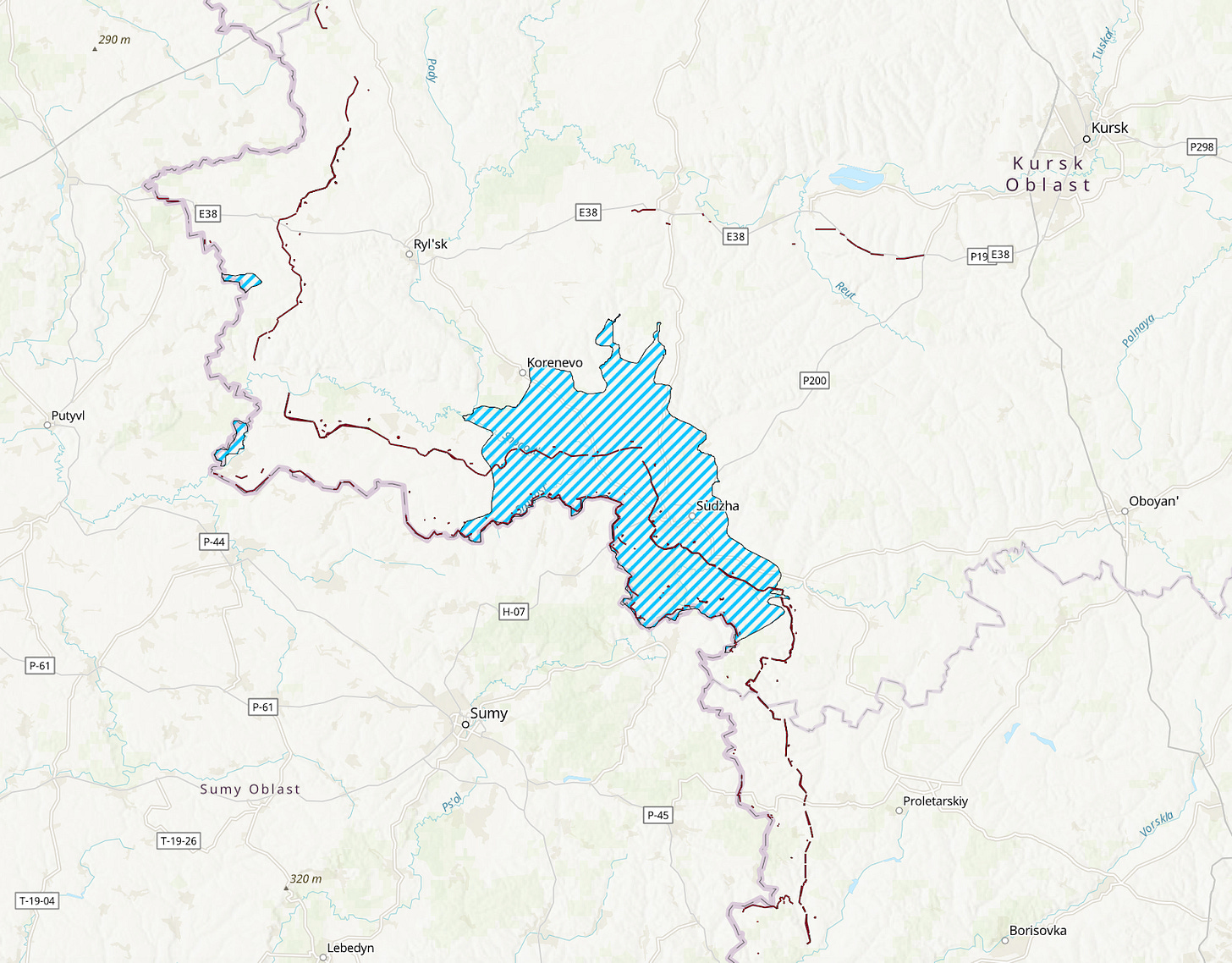

Leaving US politics behind, we had a war focus this week with Ukraine in headlines. Ukrainians are still in the Kursk region, but as I said last week, nothing substantial will come out of it for the Ukrainian side.

I am starting to write a deep dive on Ukraine as I expect that with summer ending and fall approaching fast, we will once again hear a lot about the region due to severely damaged infrastructure and possible Russian advancements. This week though I will use the opportunity that the slower week gave us and write a piece on betting strategy, touching on concept of EV, hedging, etc. If you are interested in trading prediction markets, but know little about actual strategy then remember to subscribe.

Focusing on the wider world, we had little new developments in the past week. The Olympic Game have ended with another strange performance, marking an event that will be remembered not really by sport successes, but rather due to Olympic Village living conditions, appalling performances, especially on the opening ceremony and swimmers getting sick after diving into the Seine river. I hope that Tom Cruise can save the next ones.

Before we move to the global outlook, a brief on financial world. The initial panic two weeks ago subsided thanks to strong PPI and CPI print. Now Alphabet (Google) is in focus as DOJ announced that they are mulling over breaking up of the company. More of my thoughts on this later on.

Global Outlook this week

With something of a slow last week and what is shaping up to be another slow week, I will focus on some long term predictions. I had a pretty strong week on the markets with Trump tweets win so I am looking forward to some other massively EV+ trades to appear this week.

US Elections

I have already said a lot on US elections topic in the weekly recap section. For this week we have the long awaited DNC where we can expect Kamala to be officially nominated. Luckily, right wing pundits do not fail us and steadily provide exit liquidity for bets that are nothing short of bonds.

Some people entirely miss the fact that the virtual roll call has already happened and DNC will only certify the choice made by the delegates. 1% return in 3 days gives us a nice 200% annualized return on a bet that is nothing short of a bond.

Additionally, if you like a bit more of risk there is a mentions market on Kamala’s speech at the DNC.

Not a big fan of these markets, but two I posted above (especially abortion) seems undervalued and I may go in for some here. Abortion is a flagship topic for the Democrats and I see her mentioning it during her speech.

In the coming weeks I expect Kamala to do more interviews once she is the official nominee. Additionally I am eagerly awaiting the first debate that should set the tone for the remainder of the campaign.

Ending on the US Elections, I remained stable on any other trades. With relative silence market-wise up until the next debate, I gold some Yes on Taylor Swift endorsing Kamala and I am opportunistic with the rest of my bankroll to catch opportunities like Trump last week or bonds like Kamala being replaced before the DNC.

And that’s a wrap on US Elections this week.

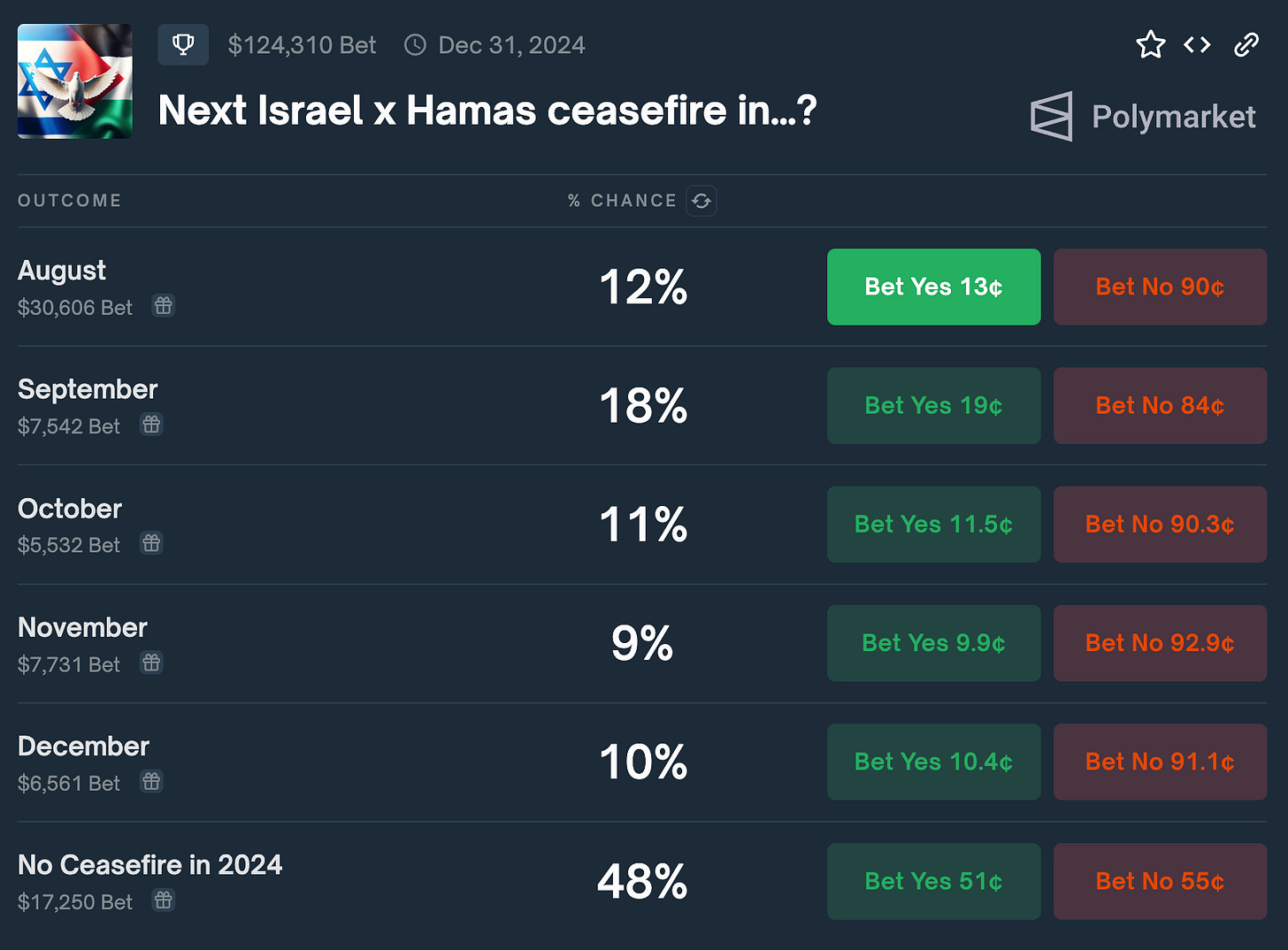

Middle East

I covered the Middle East extensively in my last deep dive, but to sum it up here for the coming week, we can expect some headlines around the ceasefire. I do not expect it to happen soon and I am not alone in this:

I do not hold any positions there as I do not see any EV+ trade to make. I might be opportunistic given some info on new proposals, etc. but overall I am aligned with these odds.

On the more long-term front in the Israel-Lebanon conflict I am considering some Yes on the invasion before November market:

Pricing looks favorable here and in the worst case scenario I would be able to capitalize on increased tension in the region in the next two and a half months.

Ukraine-Russia war

Ukrainian army is still in the Kursk region. I still maintain my position that strategically it is inconsequential and Ukraine will gain nothing out of it long-term. Also the scale of the incursion is minuscule:

I will focus more on the Ukraine in the coming months, both in the deep dive I have started to write as well as in the weekly outlooks as with the clod season approaching, we will once again see more action there. The Ukrainian war was mostly out of the headlines since the last US aid package as well as the F-16s, but it is bound to change as I expect Russia to double down after the Kursk incursion.

For now I see some value in betting against Ukraine on holding Kursk by October 31st.

Considering the low penetration and long time between now and end of October, I think 29% is EV+.

Europe

I covered Europe in the weekly recap section quite extensively and honestly for now I have nothing to add here. Prediction-wise it is a dead region and I see little change here in the near future.

Asia

Due to lack of sufficient time, I don’t really cover Asia in depth now as there are no markets to take position on besides North Korean nuke (doubtful) and Taiwan invasion in 2024 (doubtful as well).

Let me know if you are interested in Asia to cover it in the future in more detail.

LatAm

Similarly to the above, the region isn’t really interesting from global events perspective. We have some Venezuelan mess right now, but it seems that Maduro’s grip on power is strong

As above, let me know if you would like to see LatAm coverage in more detail.

Finance

Most say that we are in the clear now and the reverse carry trade drama is over. But from what I see, the credit spreads in the high-yield sector are still high, showing us some uncertainty.

Similarly to last week, I do not watch markets that closely, but if I were to scrutinize something, I would look at:

Junk bonds (suspect a lot of carry trade may have been put there)

Private credit (I have done a few deals with such funds recently and while they often have deep understanding of the industry they invest in, the risk profile of these transactions is high, very high)

Consumer: especially credit card debt, auto debt and buy now pay later outstanding debt. While markets can rip on liquidity injections form central banks, consumer is getting more and more squeezed. I would not be surprised if we start to see cracks in the near future.

In major news this week, we saw that DOJ is considering breaking Google into smaller companies. This is major news as Google is a behemoth in search, ads, video, mobile OS and many other. Overall I believe that this may be a good thing, but it is really dependent on what the actual split will be. You can cut and slice this company in many ways, but in order for it to make sense, there are a lot of factors in play.

IMO YouTube can be it’s own business easily, probably Waymo as well. Android and Chrome would have to be bundled with other business and still there is search. I am really looking forward to some Google related markets to do a proper deep dive in the topic and find some alpha. Once we see the markets appear I will definitely write a piece on the topic

Wrap up

That’s all for the coming week. Apologies for somewhat late posting and a bit shorter article - I am swamped since last week, but from now on I will have more time to focus on the newsletter. As always, your feedback on content is appreciated. Next on schedule is analysis on the Middle East so remember to subscribe.

This is not official investment or life advice. Do your own research. This are only my opinions and I encourage anyone to do their own research before putting any money anywhere.