Today is the day, huh? After such a packed weekend it seems almost surreal that it has just started. But I have been saying for months now that chaos and volatility will define Trump 2.0 - if you still have not, buckle up, we are in for a ride.

Once again overshadowed by the president himself, the week was also fruitful with many developments on the international scene. From the Americas, through the Middle East, to Asia, the last stretch of previous global cycle was packed with last minute developments.

Bear with me as we hop on a ride of our lifetimes - subscribe below if you still have not and let’s enjoy the last few hours before the storm.

Weekly Outlook

Trump, Trump, Trump. We will get nauseous repeating his name in the next four years, but the people have spoken. Let’s see what he is cooking for us, as he proved that he is already well engaged in all kinds of global affairs.

United States

You must have missed me yesterday, so I will stay with the US topic for a bit longer for a few comments on Trump’s inauguration speech. Starting with markets, as we have seen a massive mispricing, in both directions. Prime examples:

Crypto with 45/55 odds (No resolution),

Elon Musk with 35/65 odds (No resolution),

TikTok with 25/75 odds (No resolution),

Drill Baby Drill with 15/85 odds (Yes resolution).

Fueled by the recent memecoin launches, traders were betting heavily that the speech will not be usual. They were partly right - it was indeed unusual, but in a different sense. Trump did not go into techy details, but he did go into expansionism (Manifest Destiny anyone?) and space exploration (planting the US flag on Mars).

Trump seems to be really set on doing whatever he wants. For the better or for the worse, we are bound to see many unusual moves. If anything, the speech set a lot of expectations.

Coming back to original programing, just before the inauguration, the US politicians are busy confirming (or rejecting) Trump’s Cabinet nominations. With most nominees being fairly “normal”, the main issues were and are with Pete Hegseth for Secretary of Defense and Tulsi Gabbard for Director of National Intelligence.

While some are betting hard on it, I do not have a high conviction that the hearing will go south.

For yet to be seen reason, Biden in his last days has removed Cuba from the list of state sponsors of terrorism. In return the US got back 553 political prisoners, thanks to Catholic church brokerage. Interesting.

Lastly, the LA fires are now partly contained, however Gavin Newsom is still pressured to resign due to supposedly mismanaging the fires.

The Americas

In Canada the drama continues with Mark Carney, the former governor of the Bank of England, looking to get the party leader and PM spot. Inconsequential to be honest, as we are approaching new election where the party of Pierre Poilievre is looking to get the top spot.

In the meantime, Venezuelan officials are suffering from new sanctions by America, Britain and the EU. The strategy though is hardly working - the country of course is in tragic condition, but it does not stop Maduro from clinging to power easily.

Asia

In Asia, the Yoon impeachment is slowly moving forward. We are still months from final conviction, but it seems that the president accepted his fate.

Middle East & Africa

Middle East is where we had the main development last week. The Israel x Hamas ceasefire in Gaza is now officially in. There is more to it than meets the eye, take a look below for my full analysis of the deal:

From other news, Lebanon’s government is undergoing some fundamental changes. Hezbollah is losing its grip on power in the government as General Joseph Aoun, the commander of Lebanon’s armed forces, was elected the country’s president after selecting Nawaf Salam, head of the International Court of Justice, as prime minister.

Also, let me know if you want more focus on Africa - despite being severely underdeveloped, the region is especially important for Team West and Team East die to its vast resources and ability to easily influence the governments.

Europe

In Europe we are hearing more and more news from the Ukrainian front, as expected. This week the increased naval presence in the Baltic and capturing of two North Korean soldiers topped the headlines.

We can expect less undersea cables being cut and possibly some info straight from North Korea that could aid me in the further analysis of the war. For now, all eyes are on Trump to make an unlikely ceasefire deal.

Business, Finance & Economics

As January comes to an end, we are seeing more and more economic data.

US

In the US we have the new CPI print at 2.9% marking a third consecutive increase in the rate. Thus the yields remain stubbornly high, anticipating a pause in the cutting cycle. I agree with it, especially considering recent revelations with Trump coin - such things usually mark the top. My take is that any further developments on the geopolitical scene (eg. new front in the South China Sea) can trigger a recession.

From business side, two-faced Mark Zuckerberg is now cutting all DEI programs in Meta. Word of advice: do not trust him.

Also Jeff Bezos is making his dreams come true with his newest rocket launch into the orbit. Sadly, they failed to recover the first stage.

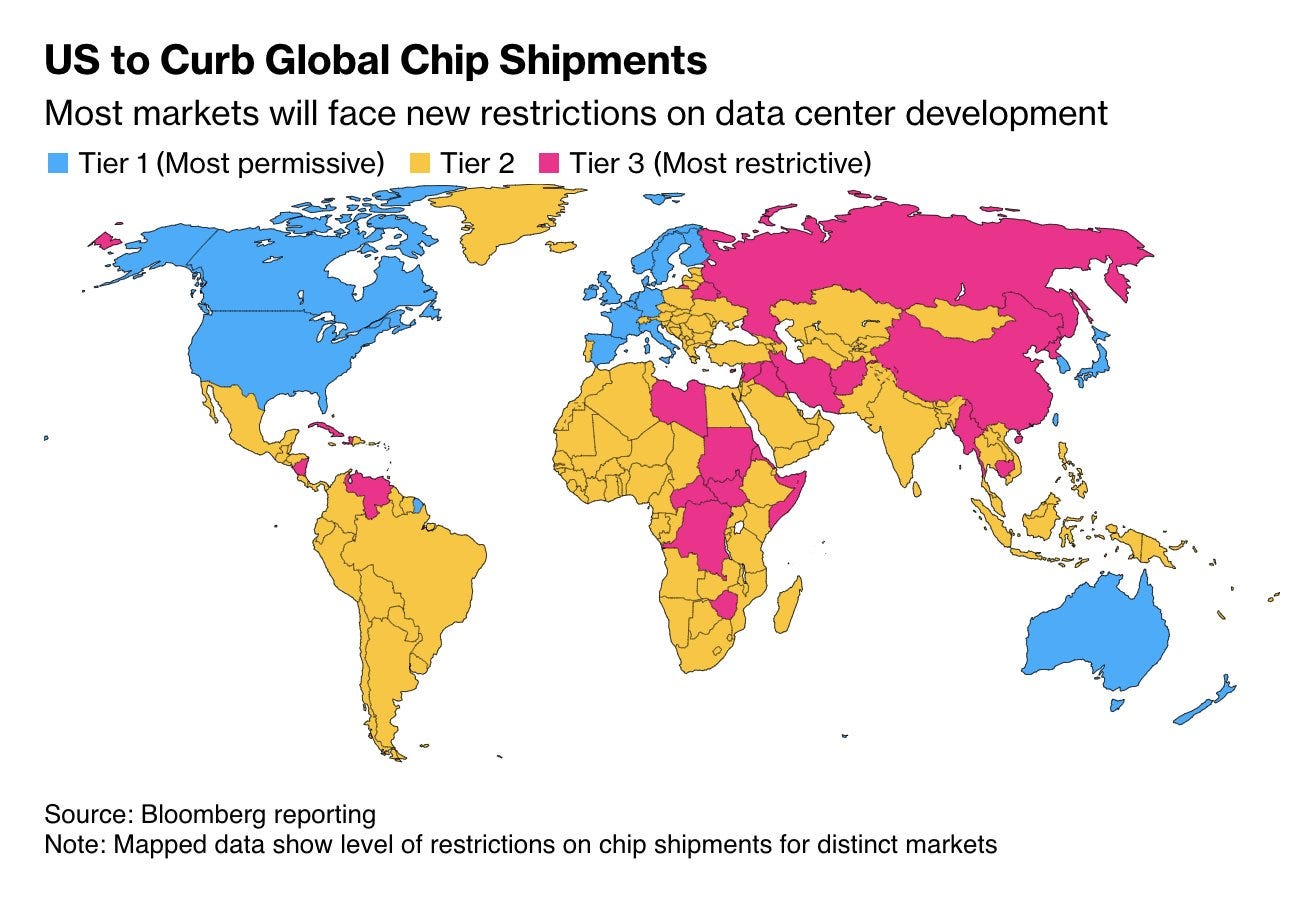

Lastly, the Biden administration imposed new restrictions on exporting chips. Notably Poland was delegated to tier 2 - I guess that is what you get for being the best allies to the US in the CEE, spending for defense well above the NATO target.

Rest of World

Meanwhile, in Argentina the inflation eased to 117.8% in December (sic!) from a peak of 289% in April (monthly level at 2.7%). Massive win for Milei, especially considering budget surplus.

Good news for the US as well, as they are poised to gain a major ally in the South America.

Moving to Europe, the German economy has shrunk the second year in a row by 0.2% (0.3% in 2023). Germany is struggling with expensive energy after the Ukraine invasion and increasing competition in the car industry from China. I have already predicted a recession in Europe in 2025, all signs point to this being right.

Markets ending this week

Moving to markets, this week the champion was the Trump inauguration speech mentions market with massive mispricing. That is in the past now, so let’s take a look a the rest of the week.

Keep reading with a 7-day free trial

Subscribe to PROPHET NOTES to keep reading this post and get 7 days of free access to the full post archives.