Weekly PROPHET NOTES 10/7/24

Global Outlook: the Middle East, the Middle East and the Middle East

Like clockwork, after a couple of silent months the Middle East is back in the headlines in full force. The men in power allowed OSINT accounts to once again farm massive amount of engagement as the situation unfolded in the last week. Pardon my cynicism, but the whole drama and telegraphing around the situation makes it a bit ridiculous. On top of that I had a busy week myself on my W-2, but that did not (and will not) stop me from staying on top of things and posting a deep dive on how I see the situation. You can read it here:

The world was not only focused on the Middle East though. Some of you may not remember by now but we had a VP debate on Tuesday and Helene hurricane wrecking havoc in the Southern US. It seems that some weeks are painfully slow while the others (like the last one) are just overfilled with new events. I guess that variance catches me everywhere, not only on the market returns.

As I also said in the last article, due to the sheer amount of work I put into these articles and caring for paid subscribers, the markets section of the weekly outlook will now be available only for the paid subscribers. If you are a free subscriber, the weekly recap and a brief on most important events in the next week is still available to everyone, but I strongly encourage you to subscribe to paid to get access to market commentary and great alpha.

Enough of introduction, let’s move towards a short summary of the week and what lies ahead.

Weekly Recap

There is a lot to unpack here so let’s go and see the mix of ended markets and other events that unfolded in the last week.

US Politics

First on, let’s take a look at the VP debate. On the mentions markets every bet hit:

As expected, the debate focused mostly on the main candidates and their policies. For a short comment, objectively JD Vance had a better performance. He is a great speaker and it showed. Tim Walz was not bad himself, but compared to JD Vance he was just worse. Also what some publications call misspeaking, he has a problem with lying. He makes stuff up to make him look better. It is not like other politicians do not do it (they all do it), but he seems to be doing it more often and is caught more often. Not a good look for a prospective VP a month before the elections.

In other US news we had Longshoremen (ie. the guys who unpack containers) have probably the shortest strike in recent times. Their threats must have worked as in a matter of a couple of day they managed to reach some sort of consensus and agreed to go back to work at least till January. Election drama for Kamala averted. Question is at what cost?

For a bit of fun we also had Elon Musk appearing at Trump rally. This guy is all in on Trump winning an election. From what is known about Elon, he does not hedge and it shows. Interesting bet from his side and he has a tendency to be right. This election in general is full of interesting big bets. Besides Elon, Bill Ackman and David Sacks are also betting on Trump to win.

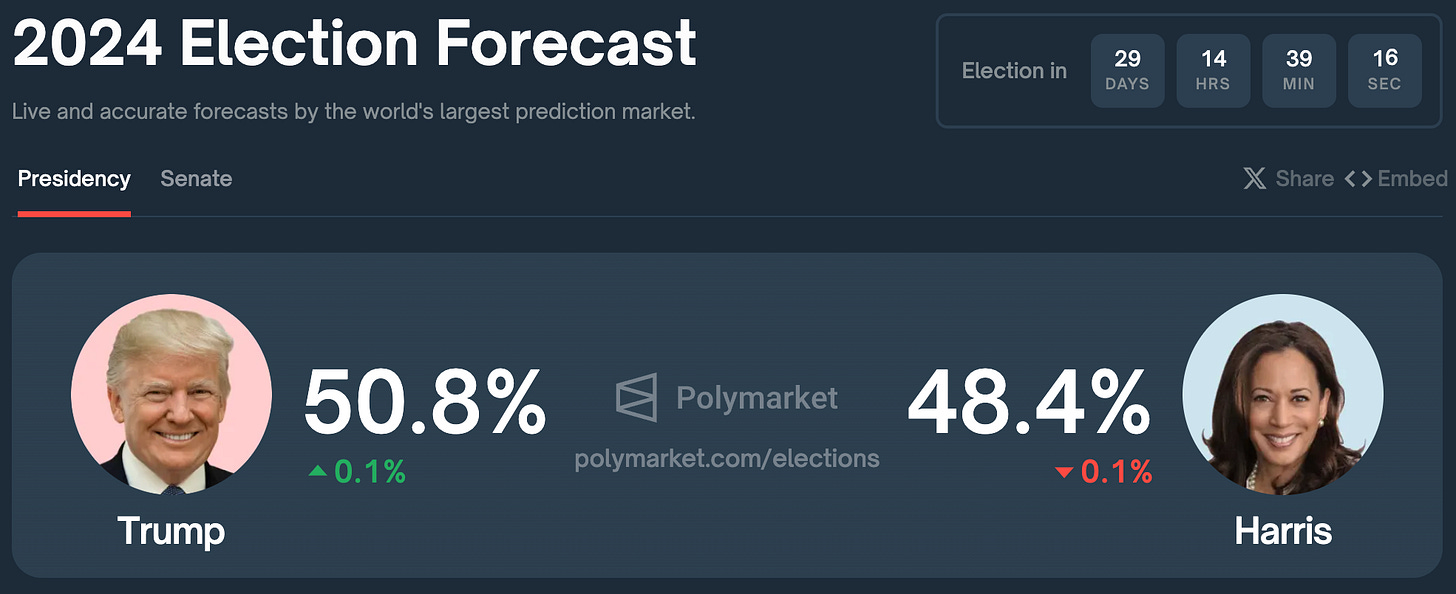

All this resulted in Trump having a slight lead in the odds:

I will be back with more US politics later on.

Wars

This week was full of war drama. With Israel’s invasion into Lebanon in full swing and ca. 200 missiles launched on Israel from Iran, majority of the headlines focused on the situation in the Middle East.

With that we have yet another dispute market on invasion in September. With selected operations happening in September some argue that the invasion started already in September. But by the rules invasion required establishing control over any position in Lebanon which did not happen in September. Looks like this one will go to No eventually, but previous UMA resolutions tended to favor vibes vs rules so this is a curious outlier:

Now (almost) everyone is expecting an Israeli retaliation with current odds sitting at 89%:

You can read my take on this in the article linked in the introduction. On top of what happened, we now have General Michael E. Kurilla, commander of US Central Command in Israel. Some say he is there to coordinate US and Israeli actions ahead of the retaliation. I say he is a glorified babysitter that is there to make sure that Israel will not do anything stupid. Coordination is middle management job. Latest reporting suggests that the US got little heads-up before latest Israeli operations and it seems that with the stakes so high US wants to make sure to be on top of the situation. We are bound to hear more on this in the next few weeks.

That is all major news from last week, let’s look ahead.

Global Outlook

I am looking ahead and I see wars. Next week will be dominated by war narrative. With presidential debates probably done, the US elections campaigns in their final stretch focus on rallies and trying to convince the last few independents to pick a side. And the situation in the Middle East may have a big impact.

While geopolitics and politics gets majority of the airtime, we are also looking forward to the CPI print this week. A good print may induce the Fed to cut another 50 bps as some say, but the markets for now heavily favor 25 bps cut:

From my point of view, another 50 bps cut would be very bearish as it would be a sign of panic.

From other interesting stuff we also have the HBO documentary on Bitcoin coming out with supposed reveal of Satoshi Nakamoto real identity. I personally doubt they will have any real evidence, but let’s see.

Markets ending this week

Keep reading with a 7-day free trial

Subscribe to PROPHET NOTES to keep reading this post and get 7 days of free access to the full post archives.