Hello anon! What a year huh? And it’s only January. Global overlords are treating us to crisis after crisis. Of course nothing big happened, but the fearmongering is strong. If you are paying attention you can see that the least you can do is make money on the trumpets of volatility that sound so loudly recently. After this a bit poetic entrance, there is actually one very important topic I want to go through today, which can actually make or break your bets on prediction markets. And this is no joke - small (and probably big as well) fortunes were made on this and if you are careless, you may be the next contributor to someone’s big hit.

Today’s post will be on the technical side. Not so fun as big predictions, but to participate in this great opportunity which is prediction markets, you need to understand how they work. You don’t want to earn initial big gains on your big brain bets just to see them all wiped away due to not understanding how resolutions work. This is no joke and I’m talking from experience - didn’t lose a fortune, but it stung, mainly because I believed I was right up until the end. So let’s jump straight in.

I will focus on Polymarket process only as this is:

the biggest prediction market

available in most countries

the one that is standing for a long time deeming it reliable in my POV

So who actually decides?

We should start with the not so obvious - who actually makes a decision on market resolution? You could say Polymarket team, market creator, automatic resolution, etc. But all of these solutions have one issue - if there is small number of people that have power to decide a market, there is high chance of market manipulation. Automatic resolutions also are not something that is currently possible.

The Polymarket team decided that prediction markets should have a resolution process that is quite similar to the resolutions in events of contractual disputes between businesses. To draw a comparison, these are the parties to the whole process vs what is happening in business environment:

market participants (businesses that entered into a contract between each other)

contract itself

mediator - in Polymarket case it is UMA while for businesses these are courts

Market participants

You are market participant. You and everyone who purchases shares on a given market. That’s the very simple part. But when you decide to purchase some Yes / No shares, you enter into a contract between other market participants.

Contract

Now we are heading to the important part - market rules. Market rules are nothing else than specific resolution criteria. This piece of text specifies which conditions need to be met for the market to resolve to Yes or No. AND THIS IS THE ACTUAL “MARKET” YOU ARE BETTING ON. Not the title. The rules. This is what matters. This is the contract you are entering when you click place limit order (or market buy if you are redacted). You need to read this very carefully as sometimes these rules are either not very specific or suggest other resolution than the title. Let’s have an example.

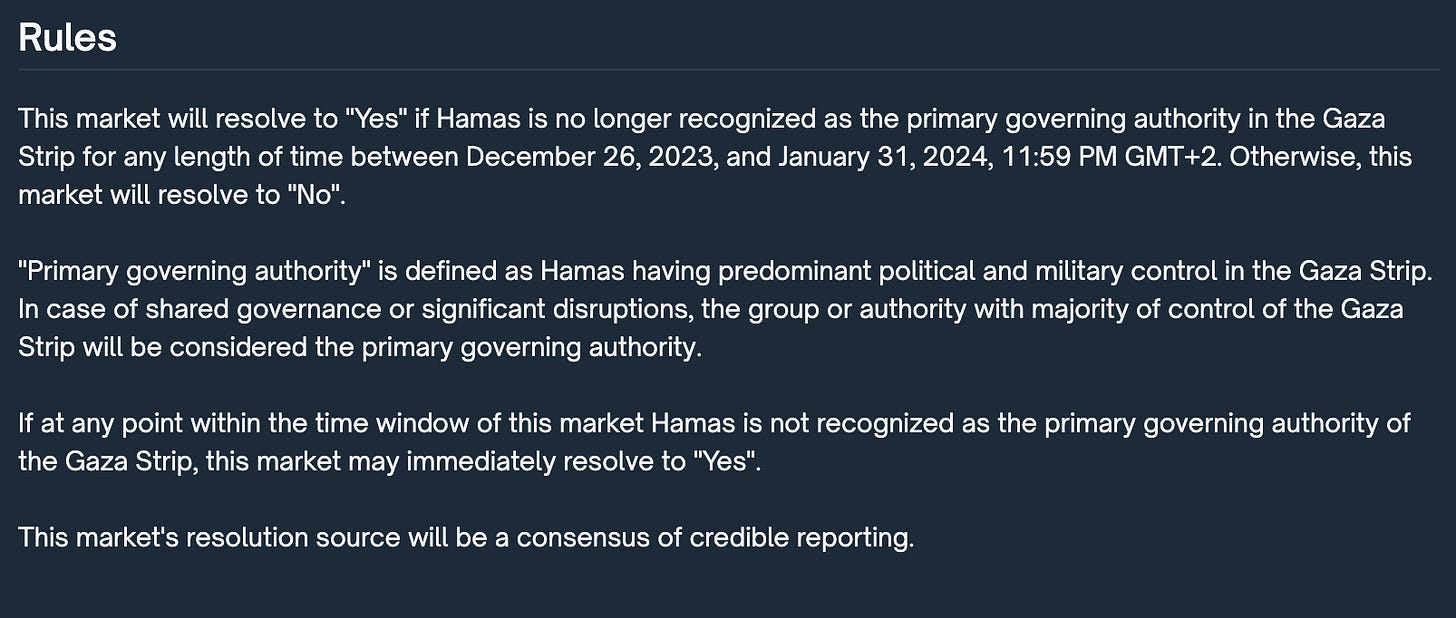

This market - Hamas lose power in Gaza before February? at a first glance is fairly simple market. Hamas lose then market resolves to Yes. But the rules give us a different picture.

Per rules you are given a definition of “Primary governing authority” that should be determined by a consensus of credible reporting. But let’s dig deeper into it. Primary governing authority can be 2 things:

predominant political and military control in the Gaza Strip (notice the “and” in the definition suggesting that both conditions need to be satisfied)

in case of shared governance or significant disruptions, the group or authority with major control of Gaza Strip

In the first case we are provided with clarification, but ultimately we are given no conditions that have to be met to constitute a predominant political and military control. What is it actually political control? What is military control? For everyone it can mean a different thing.

Second case is also botched. Who can actually confirm which parts of Gaza Strip are controlled by whom? MSM? IDF? Hamas? There is not a single source that can credibly confirm who controls which territory.

So in the end we’ve got ourselves our contract (rules) which leaves so much ambiguity to the resolution that each betting person can interpret it differently. Try to guess (the market is already resolved) what should the answer be. Did you guess No? Or did you guess 50/50 as it cannot be credibly resolved? Or maybe yes… If you were the market majority you guessed No, and you are wrong - resolution is for Yes.

Key lesson from here is - do not bet on markets with ambiguous rules until you have a deep understanding of the resolution process and feel confident you can game it. Not financial advice.

Mediator

And now the most controversial part. So who actually decides when should a market resolve and how. In Polymarket’s case it’s UMA - a self named optimistic oracle. In short, if you are a holder of a UMA token, you can stake it and thus participate in resolution processes (not only on Polymarket). You can vote with your staked tokens and voting results are proportional to the tokens you hold. If there are 10 tokens staked and voting, and you vote with 1 token, you have 1 vote out of 10. Same, if you have 6 staked tokens, you single-handedly decide the resolutions as you have 6 in 10. In practice no one holds majority of the tokens, but there are a few whales who have large sway over the resolution process.

Step by step market resolutions process:

Event occurs / end date is past

Some market participant proposes a resolution to UMA (and provides a 750 USDC bond, sometimes more)

If the resolution is not disputed, in a few hours the market is resolved and no voting takes place

If the market is disputed (ie. other market participant puts up a bond saying resolution should be different) it goes to discussion phase in which different market participants and UMA token holders debate over a resolution

Voting takes place in rounds (usually up to 2 days for the whole process)

Final resolution is the effect of the votes

Market is resolved in a few hours

As you see, the process gets quite lengthy with the dispute and UMA holders can either be persuaded to vote a given way or be market participants themselves with hidden incentives. That’s not usually the case, but what happens is that they “try” to vote with “market spirit” in mind. What this means in practice is that they are willing to stretch the market rules to accommodate the most popular narrative. Bad thing for prediction markets.

This is probably the single most important tendency / rule to remember as you will see that in some markets you will be betting on UMA holders thought process vs actual market in question. These markets can go both ways - the one I used as an example resolved to Yes despite the lack of any evidence that Hamas lost actual military AND political control / lost over 50% of territory, just because Israel is winning is a dominant narrative (most probably also true, but that was not the point of the market). Hamas is still representing Gaza Strip in negotiations and IDF invasion is not a walk in the park. Otherwise this short stretch of land would have been already taken.

Conclusion

Many market participants are not very happy with UMA. Scratch that. They are very unhappy and angry and there are voices to replace it with a better resolution process. But for now there is no better process and no one has proposed any. So we are stuck with it for now and just have to live with it.

Remember to always read and understand the rules before betting on any market. This was only one example of how strange resolutions can be - there are a lot more. As you can see in the quoted example, resolution was different than market consensus, which shows that they can go both ways.

Also now most of the markets have clear enough rules so there are no disputes and bets are safe. Just look out to not have a bad surprise.

Stay strong anon and bet smartly with your new knowledge.

Disclaimer

This is not official investment or life advice. Do your own research. This are only my opinions and I encourage anyone to do their own research before putting any money anywhere.